Managing Bracket Orders

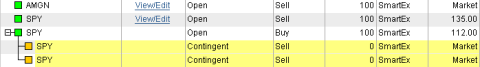

Once you submit a primary order with a bracket, the bracket portion of the order

will display as a contingent order under Order Status & Messages tab

in the My Account tab.

You can also add, change, or remove bracket orders from the Order Status

view, just as you can with non-bracketed orders.

- When you first submit

a primary order with brackets you will see that the bracket quantity will

display as zero ‘0’. Brackets only become active once a fill has been

received on the primary order. As fills are received the bracket’s quantity

will increase and the Current Trigger

Price will adjust based on the average price of those fills.

- Canceling the primary

order will also cancel the bracket orders associated with it as long as

there are no fills against the primary.

- Partially filled primary

orders will already have active bracket(s) on the filled shares or contracts.

Canceling the remaining unfilled portion of the order will not impact

the brackets.

Stock symbols and price and volume data shown here

and in the software are for illustrative purposes only. Charles Schwab

& Co., its parent or affiliates, and/or its employees and/or directors

may have positions in securities referenced herein, and may, as principal

or agent, buy from or sell to clients.

Adding Brackets to a New Primary Order:

- In the Trading tab, choose

a Buy or Short order action

(for option orders, click Buy

to Open or Sell

to Open).

- Set up the details of

your primary order, including order type, quantity, limit price, time

in force, and any special conditions.

- Click Add

Bracket if the Bracket panel is not already open.

- In the Bracket panel,

choose which type(s) of bracket you wish to use in your risk management

strategy for this position: Profit

Exit, Trailing

Stop Exit, and/or Stop

Loss Exit. See Bracket Overview

for descriptions and examples of each.

- Set up the parameters

for the selected brackets, while confirming that the Est.

Price (for Profit exits and Stop Exits) is in line with your expectations.

The estimated price is based on either the designated Limit price for

a Limit or Stop Limit order, or the last Trade price if your order is

a Market or Stop order.

Once the primary order receives a fill, that fill’s price is used to

calculate the actual trigger price. If multiple fills are received at

different prices, those prices are averaged together and the average fill

price is used as a basis for the calculation.

Adding Brackets to Open Orders

- In the Order Status panel,

click on the order you are adding brackets to and click Apply

Bracket.

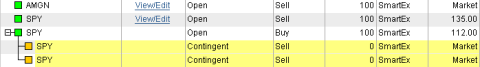

- The order will open in

the trading panel. Check the bracket parameters you wish to add, and specify

the values and units for each.

- Click Verify

Order. The brackets now display as contingent orders in your Order

Status tab.

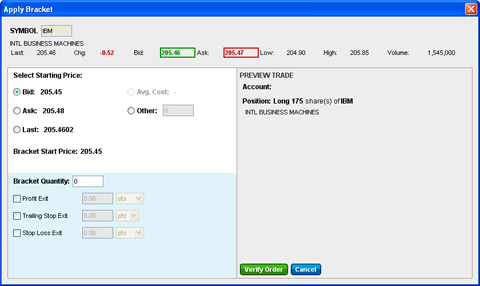

Adding Brackets to Positions

When you establish a bracket at the time of order entry or from the order status, the starting price is automatically based off of the average fill price OR for trailing stop brackets, off of the Bid or Ask at the point in time the bracket becomes active. However, when you establish a bracket AFTER the order fills (in other words, now that it's a position rather than an order), you will need to specify a starting price and quantity.

Stock symbols and price and volume data shown here

and in the software are for illustrative purposes only. Charles Schwab

& Co., its parent or affiliates, and/or its employees and/or directors

may have positions in securities referenced herein, and may, as principal

or agent, buy from or sell to clients.

- Select a starting price from the Bid, Ask, Last, or enter a custom price in the Other field. If you are adding the bracket to a position with multiple fill prices, Avg Cost will also be an available selection.

- Enter the portion of your position to which you wish to apply the bracket in the Quantity field. Click the arrows to increase or decrease the quantity by 100 share increments, or type a number in the field.

- Choose which exit(s) you wish to use in your risk management strategy for this position: Profit, Trailing Stop, and/or Stop Loss. See Bracket Overview for descriptions and examples of each.

- Set up the parameters for the selected brackets, while confirming that the Est. Price is in line with your expectations. The estimated price is based on the Starting Price you selected above.

- Click Verify Order, and then if the order is satisfactory, click Place Order. The brackets will then display in the Order Status tab, where you can view, edit, or delete them as necessary.

Editing a Bracket

Changing a bracket prior to it triggering does not affect the primary

order.

- In the Order Status panel,

click the bracket order you wish to change and click Change.

- The order will open in

the trading panel. Edit the bracket parameters as necessary.

- Click Verify

Order when you are finished.

- If your primary order

has already received fills, you will see the current trigger price adjust

based on the change in the bracket’s value.

Canceling a Bracket

In the Order Status panel, click on the bracket you wish you remove

and click Cancel.

If you wish to remove all bracket orders at once, click Change

and uncheck the bracket checkboxes.

Notes on Changing or Canceling Primary Orders

- Changing

a primary order: Generally a primary order can be changed without

impacting the brackets. Changes to the limit price will impact the fill

prices, and those will be taken into account as fills are received and

the new trigger prices are calculated for the exits.

- Too

late to cancel: Orders can fill quickly, so it's often the case

that a command to cancel the primary order is too late and is rejected

by the system. This simply means that once the primary order executes,

brackets will be placed in the market now that an open position exists.

- Changing

a partially filled primary order: When you change a partially filled

primary order, you are essentially canceling and replacing the old order

with a new order.

When brackets are associated with the order, they remain linked to

the filled portion of the order, and the quantity and trigger price are

based on the executions up to the point the order was changed.

The new order created by the change, which consists of the unfilled

portion of the original order, will have a new set of brackets linked

to it. Any new fills of this order will be used to increase the bracket

quantity and calculate the new trigger price. - Canceling

a partially filled primary order: If an order partially fills,

any brackets that were part of the order will become active for the number

of filled shares. If you cancel the remainder of the unfilled shares,

it will not affect the filled shares or its brackets.

- Voided

Executions on the primary order: If the primary order receives

one or more voided fills, any brackets against that order will be automatically

deactivated (if the full quantity is voided) or adjusted for the remaining

valid shares that are still open or have filled.

- Brackets

triggering while the primary order is still in open status: When

the first fill is received for the primary order, your brackets begin

being monitored in the event that one of your target exits is met. If

the price touches one of these exits, the bracket will trigger an order

and the remaining brackets will be cancelled.

When this occurs, a new set of bracket exits will be established automatically

and any new executions for the primary order will be applied to the new

bracket set. Any single primary order can only have one bracket set in

contingent status at a time. - Bracket

Exits triggering before the position is updated: Occasionally,

usually due to unusually heavy market volume, StreetSmart.com® does not

immediately receive position updates. This condition coupled with high

volatility can result in brackets triggering before the position is received

by StreetSmart.com. When this occurs, the bracket order fails. When placing

trades in these marketplace conditions, setting looser bracket exits will

still help provide protection but allow for the system to update properly

and may prevent you from being closed out of your position prematurely.

- Effects

of corporate actions: Order

quantities on brackets will not adjust due to corporate actions, including

but limited to stock splits, stock dividends, spin-offs, mergers, and

name changes.

Copyright ©Charles Schwab & Co., Inc. 2005-

2014. All rights reserved. Member SIPC.

(0814-5339)