About Brackets

|

Brackets allow you to integrate your risk

management strategy directly into the creation of an equity or option

order. Using brackets you can predefine profit and loss targets for trades

where, if those targets are met, the software will automatically send

an order to exit the position.

To use

brackets, check Spec Cond &

Brackets in the Trading Window

when entering an order.

See examples

of Bracket orders or take

the Self-Guided Tutorial.

|

Bracket orders are conditional orders you can attach to your stock or

option orders. They consist of a primary order and up to three contingent

orders, which if triggered, will close out the position opened by the

primary order. Brackets can provide automated risk protection for your

open positions regardless of whether you are logged on to the software.

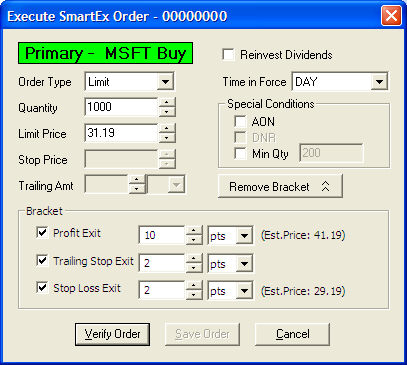

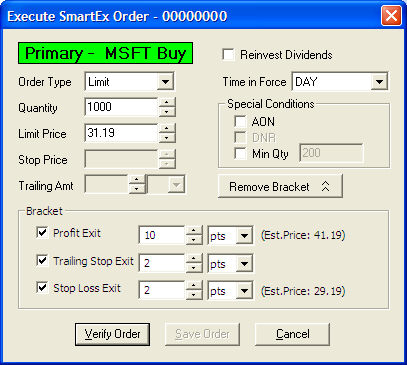

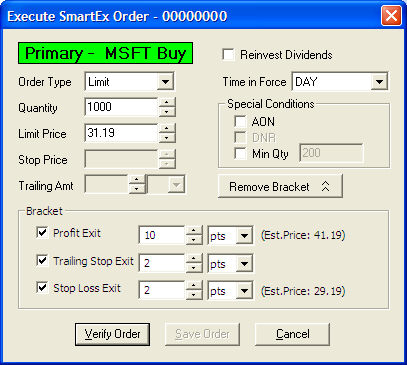

When you check Spec

Cond & Brackets and click

Buy or Short

(or for options,

Buy to Open or

Sell to Open), a second window opens, where you can specify the

terms of the bracket order(s).

TIP: Brackets

can also be added to orders initially opened without brackets. See Managing Bracket Orders for instructions.

Stock symbols and price and volume data shown here

and in the software are for illustrative purposes only. Charles Schwab

& Co., Inc., its parent or affiliates, and/or its employees and/or

directors may have positions in securities referenced herein, and may,

as principal or agent, buy from or sell to clients.

Certain aspects of the bracket orders are predefined:

- The quantity of the bracket

order(s) will always be equal to the quantity filled in the primary order.

- Brackets remain active

with their primary order or primary position (when the primary order fills)

indefinitely, unless they are manually removed or are triggered and filled.

- Bracket orders can be

set up for any equity or option order that opens or adds to an existing

position, regardless of the venue of the primary order.

- Brackets on symbols with wide spreads may not fire if the spread is too wide.

- Bracket orders are only

active during the standard session (9:30 a.m. ET to 4:00 p.m. ET)

- Bracket orders are always

sent as a SmartEx Market order

regardless of the primary order's routing venue.

- Bracket orders trigger

off the bid/ask price for both stocks and options.

- While the Est.

Price is calculated off the Limit or Inside bid/ask price (for

market orders), the actual exit trigger price will be based on the average

fill price from the primary order. See the Bracket

Order Examples topic to get a better understanding of brackets in

action.

- Note:

Brackets will not adjust price

or quantity of shares due to corporate actions, including but NOT limited to stock splits, stock dividends,

spin-offs, mergers, and name changes.

- Bracket orders will not

function on boxed positions.

- Brackets placed on stocks

that do not have bid/ask quotes, including Pink Sheet securities will

not activate.

- When placing a bracket

order to sell and close out a long position,

if the tradable quantity of your position is less than the quantity you

specify in the order, the software will send the order for the lesser

amount rather than rejecting the order due to insufficient shares available

to trade.

You may establish up to three types of exits:

- Profit

Exit: Specifies the increase (or decrease for short orders) in

value from the average fill price required to trigger the profit exit.

The value can be a certain number of points (pts) or a percentage change

from the execution price, or the exit price itself.

For example, if you bought a stock at $10 and wanted to exit the position

at $12, you could enter 2 pts, 20%, or $12. The Est.

Price label will show you what the likely result might be if the

Profit Exit is triggered, but that price will be adjusted if the average

fill price on your order is different.

- Trailing

Stop Exit: Specifies the amount you are willing to let a stock

or option price go against whatever gains it may attain. This exit is

valuable in helping you retain as much of your gain in a position as possible

before closing it out. The value can be a certain number of points or

a percentage of the execution price.

If you use a trailing stop exit in conjunction with a profit and/or

loss exit, the trailing stop will operate between these two exits. If

either of the profit or stop loss exit prices are met, the bracket will

trigger regardless of any trailing stop you may have set.

For example, if you bought a stock at $10 and wanted to protect yourself

should the market move against you 5% (or .5 points per share) from the

execution price, the trailing stop would place an order to close your

position only if the stock price loses 5% from its highest gain. The worst

case scenario is that the exit order would go out at $9.50 because it

simply never gained on the execution price. Conversely, the stock might

not hit resistance until $14 before it drops .5 and the order is triggered.

If you had also set up a profit exit of 10 % and a loss exit of %3 in

conjunction with your trailing stop exit, the bracket would trigger at

either 3% below the execution price or 10% above that price if met. This

would occur regardless of your trailing stop calculation.

- Stop

Loss Exit: Specifies the decrease in value (or increase for short

orders) from the average fill price required to trigger the stop loss

exit. The value can be a certain number of points (pts) or a percentage

change from the execution price, or the stop loss price itself.

For example, if you bought a stock at $10 and wanted to ensure that

you won't lose more than 10% on the trade, you could enter 1 pt, 10%,

or $9. The Est. Price label will

show you what the likely result might be if the Stop Loss Exit is triggered.

Copyright ©Charles Schwab, & Co., Inc.

2010. All rights reserved. Member SIPC.

(1010-6351)