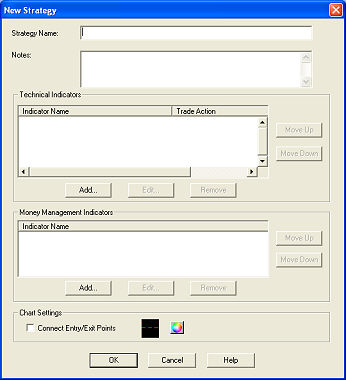

While several built-in strategies are available with your software and can be edited to suit your needs, you may also create your own custom strategies.

| NEW STRATEGY FIELDS | |

|---|---|

|

Strategy Name |

Enter the strategy name |

|

Notes |

An optional field. What you type here will be what displays when you click on the strategy in the Strategy Center. This field can be used to document the description of the strategy. |

|

Indicators |

Lists the name(s) of the indicator(s) being used in the strategy and the Trade Action they are indicating.

Multiple Indicators

|

|

Money Management |

Money Management tells the strategy to trigger a trade exit based on a pre-determined Trailing Stop, Profit Exit, and/or Stop Loss percentage. If the Money Management criteria are met, a Long Exit or Short Exit will trigger and the strategy will start over by looking for Entry opportunities.

To add two or more Money Management indicators, repeat the steps above and select the remaining indicator. On Back Test Assume: This option is only available with the Trailing Stop Money Management indicator and allows you to determine whether the test is based on more conservative (Worst) or aggressive/positive (Best) back test results. |

|

Chart Settings |

Connect Entry/Exit Points - A dashed line from the entry to the exit point of each trade is displayed when this is checked and the strategy is applied to a chart.

|

Copyright ©Charles Schwab & Co., Inc. 2013. All rights reserved. Member SIPC. (0312-2067)