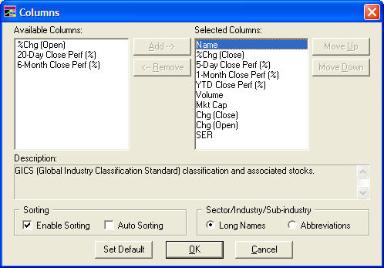

- Click Settings

> Columns

to change the data fields displayed in the Sectors window.

- Move Columns you want

to see in the Sectors window over to the Selected Columns.

- Column data can also

be changed by right-clicking the Sector window column heading.

- You can change the order

of the column data by dragging the column heading box to the desired column

location.

Enable Sorting: When checked,

you can simply click on any column header to sort by that column.

Auto Sorting: When checked,

the sort order will change in real time as new data comes through. For

example, if you were sorting by the Total Volume column and Auto Sorting

was checked, the sort order of the watch list would change as volumes

changed.

Long Names/Abbreviations: Select

which format you would like for displaying the Sector, Industry, and Sub-Industry

columns.

Sector Column Descriptions

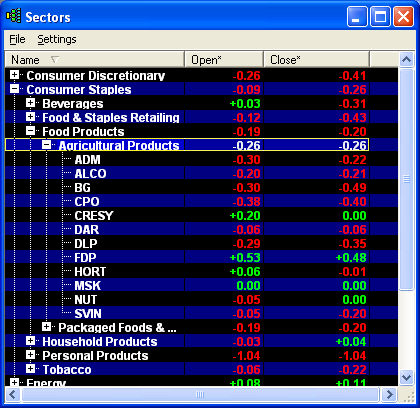

- Name:

Shows Sectors, Industries, Sub-industries,

and finally, all stocks within each sub-industry.

- Open*: Total amount the stock has gained/declined

since market open.

- Close*: Total amount the stock has gained/declined

since yesterday's close.

- Open*(%): Percentage of change from

open price to current price.

- Close*(%): Percentage of change from

close price to current price.

- Total Volume: Total cumulative volume

for the day.

- Total Market Capitalization: The total

market value of all of a company's outstanding securities.

- 5-Day Close Perf (%): Difference between

the Close from 5 days ago and the Current Price expressed as a percentage.

- 20-Day Close Perf (%): Difference between

the Close from 20 days ago and the Current Price expressed as a percentage.

- 1 Month Close Perf (%): Difference between

the Close from 1 month ago and the Current Price expressed as a percentage.

- 6 Month Close Perf (%): Difference between

the Close from 6 months ago and the Current Price expressed as a percentage.

- YTD Close Perf (%): Difference between

the close from the beginning of the year and the Current Price expressed

as a percentage.

- SER (Schwab Equity Ratings): Schwab

Equity Rating evaluates individual stock and provides a 5 point rating

scale (A, B, C, D, F) indicating Schwab's outlook on the potential performance

of the stock over the coming 12 months. More on Schwab

Equity Ratings

|

![]() in the

Toolbar.

in the

Toolbar.