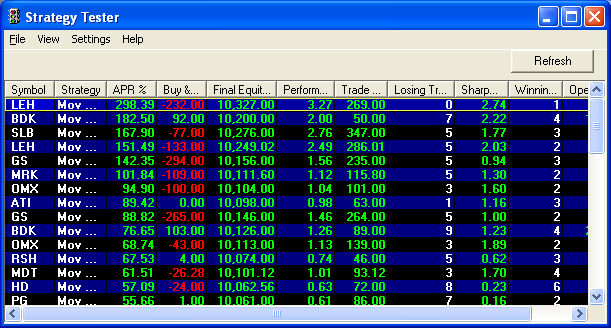

Find out how you would have done in the market if you had used a particular technical strategy. The Strategy Tester is our backtesting tool that combines technical analysis strategies with historical market data to help you make future trading decisions.

You can load results from the Strategy Tester into the Chart tool and the Strategy Ticker® tool to help you find buy or sell opportunities in real-time.

To open

the Strategy Tester, click ![]() in the Toolbar.

Only available during market

hours.

in the Toolbar.

Only available during market

hours.